Fundraising and Donations

We are extremely grateful to our Parents, Former Pupils and Staff and benefactors who kindly donate to the School. This support is greatly appreciated and all funds go towards our School Development Programme and will help us to modernise and enhance facilities and resources for our Nursery, Preparatory and Senior Students. Your support, large or small, will make a huge difference and we thank you in advance for your generosity.

If you are a UK taxpayer and would like to Gift Aid your donation which increases your gift by 25% without costing you any extra, please see The Gift Aid Scheme below.

Here are some of the projects which have benefited from generous donations:

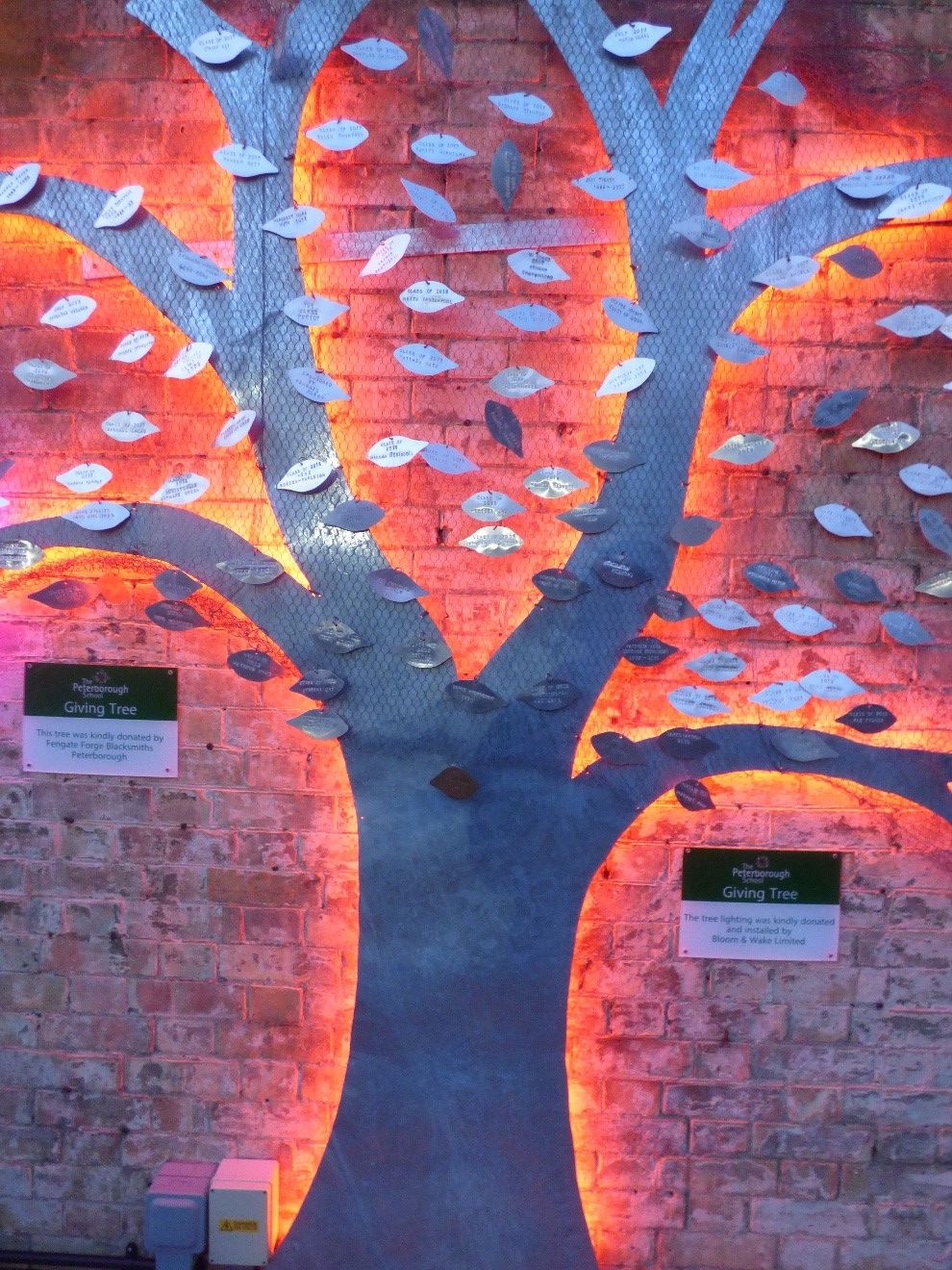

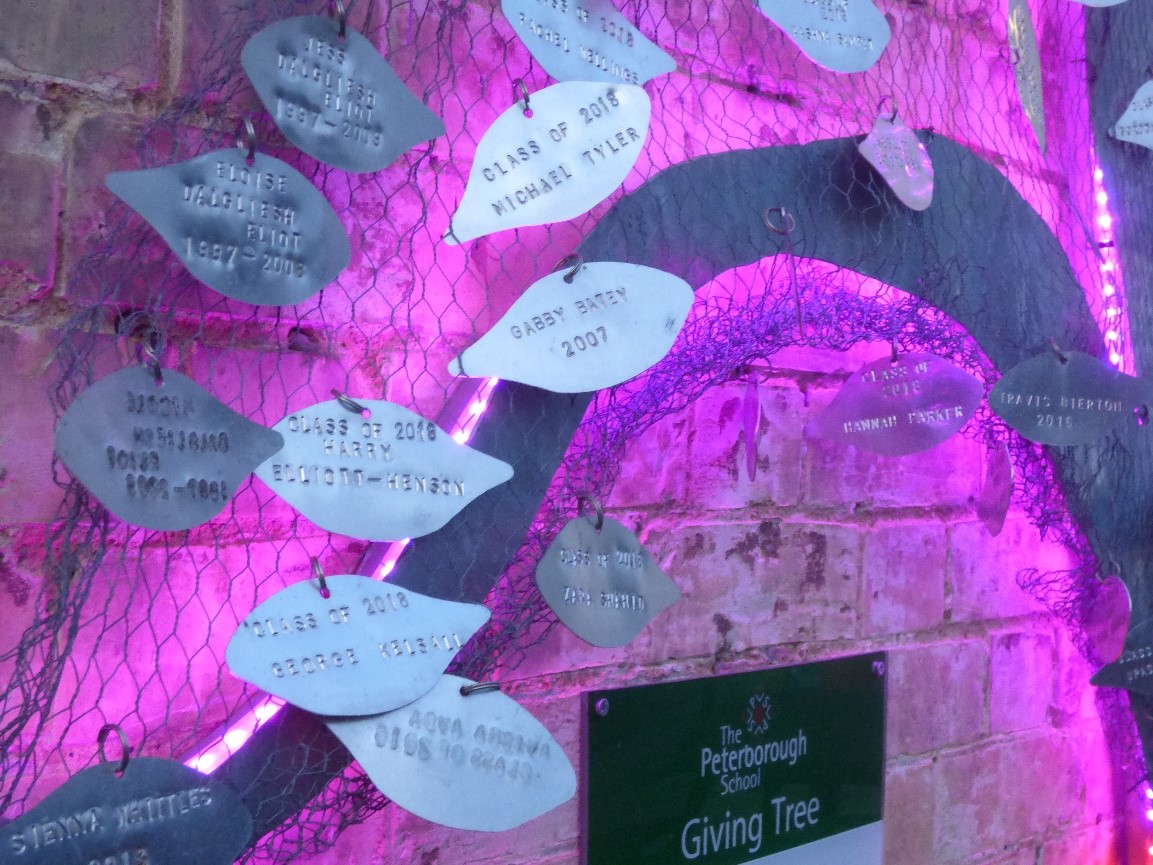

The Peterborough School Giving Tree

The Peterborough School Giving Tree - £25

The Peterborough School Giving Tree is a permanent commemoration of friends of the School – our pupils, parents, former pupils, former staff and benefactors. The idea is the tree will prosper and grow with leaves sponsored by anyone wishing to contribute. The silver coloured leaves cost £25 each and will be stamped with the names of the donors and displayed on the Giving Tree for years to come.

If you would like to have a place in the history of the School, please sponsor one or more leaves by completing the form below and watch our Giving Tree flourish.

As a school without significant endowment funds, the generosity of our donors has always helped us to develop our facilities and to support the School in delivering its vision.

Leaving a legacy is simple: it can be included in a new will or added as a Codicil to your existing will. It will be free from inheritance tax and you may, if you wish, direct your gift to be used for a particular purpose within the School.

The Peterborough School recommends that you consult legal advisors before drafting a new will or updating an existing will.

We also understand that legacies are a confidential and private matter. However, if you decide to leave a legacy to The Peterborough School in your will, it would be very beneficial to have an indication of your support so that we can recognise your generosity.

If you wish to leave a specific item to The Peterborough School, you should contact us directly so that we can ensure we will be able to meet your wishes.

To discuss your plans further, please email the Development Manager at Development@tpsch.co.uk or call 01733 343357.

The Peterborough School Limited is a registered charity in England and Wales (number 269667), and is recognised by HMRC, including for the purposes of the Gift Aid Scheme.

The Gift Aid Scheme recoups the basic rate UK tax payable on the amount donated and adds it to the gift, increasing its value to the School by 25%. A gift aided donated of £1,000 by a basic rate taxpayer is therefore worth £1,250 to the School, similar gifts by higher rate taxpayers are worth even more. If you pay Income Tax at the Higher or additional rate and want to receive additional tax relief due to you, you must include all your gift aid donations in your Self-Assessment Tax Return or ask HM Revenue and Customs to adjust your tax code.

Please seek appropriate professional advice if you are unclear how this impacts on your personal ability to Gift Aid a donation. If you pay less Income Tax or Capital Gains Tax than the amount of the Gift Aid claimed on all your donations in a tax year, it is your responsibility to pay any difference.

Charitable gifts by companies may be deducted from taxable profits, reducing a Corporation Tax liability.

If you would like to Gift Aid your donation, please complete the form below.

Charity Gift Aid Declaration

Boost your donation by 25p of Gift Aid for every £1 you donate

Gift Aid is reclaimed by the charity from the tax you pay for the current tax year. Your address is required to identify you as a current UK taxpayer.

In order to Gift Aid your donation you must tick the box below: